How Do You Lose $10 Million Per Minute for 45 Minutes Non-Stop? Computerised Trading losses Mount @ The “Dark” Knight

London, UK - 3rd August 2012, 00:28 GMT

Dear ATCA Open & Philanthropia Friends

[Please note that the views presented by individual contributors are not necessarily representative of the views of ATCA, which is neutral. ATCA conducts collective Socratic dialogue on global opportunities and threats.]

Algorithms Rule This Asymmetric Brave New World

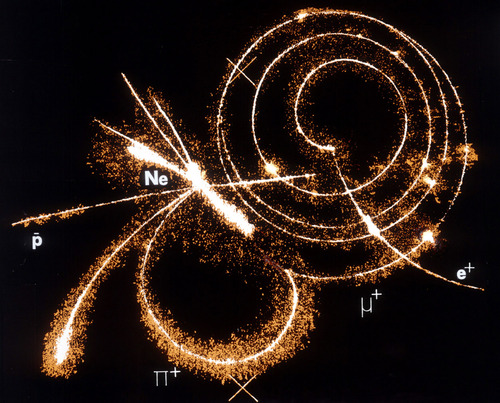

Welcome to this asymmetric brave new world ruled by computerised algorithms that are causing more chaos in minutes than what human-beings were previously able to bring about in decades. The Knight Capital Group, the Jersey City, New Jersey-based brokerage firm — one of America’s biggest market makers — announced on Thursday that it lost $440 million because of a mis-firing computer program, which carried out nonsensical trades for three quarters of an hour on Wednesday before it was shut down. The losses caused by computerised trading malfunction are greater than the company’s consolidated revenue of $289 million in the second quarter of this year, never mind its earnings or profits. Knight’s automated high frequency trading algorithmic computer program ran out of control for about 45 minutes, which means the company lost $10 million for each minute the new software was running. A non-human employee of Knight Capital — not a human rogue trader on this occasion — executed the crippling damage in less than one hour on one of America’s largest brokerage houses which had been going strong for nearly two decades.

Losses Threaten Stability of The “Dark” Knight

The losses are threatening the stability and viability of Knight Capital. In its statement, the brokerage firm said its capital base — the money it uses to conduct its business — had been “severely impacted” by the adverse event and that it was “actively pursuing its strategic and financing alternatives.” Several financial institutions announced they had stopped trading with Knight, at least temporarily. Some financial investors are openly questioning if this is the beginning of the end of Knight Capital? Its stock, which was trading at more than $10 at the start of the week, has tumbled by more than 80% as of Thursday evening in New York and is at $2.11 in after-hours-trading at the time of writing this ATCA briefing.

30 milli-second Competitive Advantage: High Frequency Trading using Neutrinos

30 milli-second Competitive Advantage: High Frequency Trading using Neutrinos

What Really Happened?

Knight Capital Group said the problem was triggered when it installed new computerised trading software, which resulted in the company sending numerous erroneous orders in 140 stocks listed on the New York Stock Exchange. Those orders were behind some sudden swings in stock prices and surging trading volume shortly after the markets opened on Wednesday. The glitch led the firm’s computers rapidly to buy and to sell millions of shares in over a hundred stocks for about 45 minutes after the markets opened. Those frenzied trades pushed the value of many stocks temporarily upwards and downwards, and the company’s losses appear to have occurred when it had to sell some of the overly priced shares back into the market at a much lower price. The New York Stock Exchange said that it was examining unusual trades in those 140 stocks. The “Dark” Knight’s self-inflicted “Flash Crash” puts back into focus the risks of automated algorithm-based high frequency trading, as 40 of the 140 stocks affected saw their share prices fluctuate by more than 10%, ie, double digit percentages.

Destabilising Effects

Knight Capital’s high frequency trading disaster is the latest to draw attention to the potentially destabilising effect of self-inflicted financial chaos that has increasingly dominated the saga of the complex financial industry and the inter-linked global financial markets. For investors, this is just the latest breakdown in the increasingly complicated high frequency computer systems that run securities trading. Those systems have been showing signs of strain as more traders and big investment firms use ever more powerful computers to carry out trades in mere fractions of a second — referred to as “High Frequency Trading” – to garner competitive advantage which translates into higher and higher profits. This massive collapse in share value of Knight Capital Group will only further serve to diminish trust in the stock market in general and is somewhat reminiscent of visible and chaotic malfunctions in recent years, chief amongst them:

1. The May 2010 “Flash Crash” when the Dow Jones index dropped nearly 600 points in five minutes because of high frequency trading glitches;

2. Rogue trading at banks like UBS and Société Générale causing multi-billion dollar losses because of derivatives;

3. MF Global, the Wall Street trading firm filing for bankruptcy after making speculative bets in Europe that went awry, destroying clients’ money and investors in its stock;

4. JPMorgan Chase’s “London Whale” trades that cost America’s biggest bank more than $5 billion in losses and its CEO his reputation; and

5. Nasdaq botching the handling of the Facebook IPO.

This latest unfortunate event, which comes on the heels of a series of unfortunate events, will also bring further uncertainty to Wall Street and financial services businesses. For example, there has been a serious slowdown in global capital markets activity — including capital raising, Initial Public Offerings or IPOs, mergers and acquisitions — which has hit key trading revenue at investment banks already.

Loss of Trust

The financial services sector has increasingly become toxic for stock investors, filled with companies that could blow up on any given day of the week, without notice, through self-induced near-suicidal acts. The question is why would anyone invest in these types of financial companies? There has got to be a safer and more secure way to invest money. These trading calamities have become so problematic and frequent that many experts believe they have shaken investors’ long term faith in markets altogether, especially after the deep losses they suffered during the financial crisis that started in August 2007 and the double-dip recession and financial repression that have followed in subsequent years. As a result, many investors have been fleeing the global financial markets altogether. In particular, financial firms are getting punished whenever there is any hint of an error or a situation where the little person is possibly being taken advantage of.

Conclusion

Rogue traders, rogue computer algorithms, financial whales, LIBOR manipulation, lawsuits: the finance industry has a lot of problems right now! We have long advocated that the dominance of High Frequency Trading (HFT) and diverse types of algorithmic models or “algos” could one day run amok and spark a massive systemic melt-down of the global financial markets, which would be on a scale that is difficult to envisage. The events of May 6th, 2010, were already a wake up clarion call and markets remain dangerously unprotected from major misfiring algorithms operating on their own or in tandem with other HFT systems as the recent “Dark” Knight episode shows. The accelerating euro crisis could trigger unpredictable event scenarios in the near future. Recent events show the kind of impact on market confidence that software trading bots going off on a tangent or “switching on and off” can cause: investors simply hate uncertainty and having these unexplained problems happening while everyone’s nervous does nothing to calm the global financial markets. Longer term systemic liquidity requires confidence that the playing field can produce winners and losers in a fair way and long term investment skills will be rewarded over short term casino gambling acumen. If traders and investors sense that markets are not only casinos, but ones where a massive software crash can wipe out everyone, they will not want to play within them at all! The rise of machines, casino trading and abrupt illiquidity scenarios is now upon us. What remains to be seen is the regulators’ response and our question would be: Can any of their collective response avoid the markets going off their rails at this late stage? [Ref ATCA 5000: Systemic Crisis: The Rise of Machines, Casinos and Illiquidity - 16th May 2010]

[STOPS]

What are your thoughts, observations and views? We are hosting an Expert roundtable on this issue at ATCA 24/7 on Yammer.

[ENDS]

Expert Roundtables

Expert roundtables are the newly launched ATCA 24/7 Q&A private exclusive club service. They seek to become the killer application in strategic intelligence by delivering an unprecedented competitive advantage to our distinguished members. They can only be accessed online at https://www.yammer.com/atca

Q1: How to become a privileged member of ATCA 24/7 to participate in the expert roundtables?

A1: i. If you are a distinguished member of ATCA 5000, ATCA Open, The Philanthropia or HQR affiliated groups you may be allowed to become a privileged member of this new and exclusive private club.

ii. If you are pre-invited, visit the private intelligence network -- PIN -- by going to https://www.yammer.com/atca [Note: In https:// 's' is for security and encryption]

iii. If you don't have membership of the PIN yet, email the mi2g Intelligence Unit at intelligence.unit at mi2g dot com for an exclusive invitation.

Q2: How to participate in the expert roundtables and get domain-specific strategic intelligence questions answered?

A2: Access the ATCA 24/7 Private Intelligence Network -- PIN -- online and ask or answer a strategic intelligence question, no matter how complex. Receive expert answers within 24 hours or get pointers from:

i. ATCA 5000 experts who are online;

ii. ATCA Research and Analysis Wing; and

iii. mi2g Intelligence Unit.

Q3: Why is the ATCA 24/7 Q&A Exclusive Club special?

A3: ATCA 24/7 has now created an exclusive private intelligence watering hole and expert roundtable at the highest level where interesting and sophisticated questions are being asked from around the world, and intelligent answers are being provided, almost always by experts who have deep domain-specific knowledge. Come and check out the exclusive club, take it for a strategic test drive, which sign-of-intelligent life are you waiting for?

To learn more about "The Expert Roundtable: ATCA 24/7 Q&A Club" email: intelligence.unit at mi2g.com and if you are already a member visit https://www.yammer.com/atca

We welcome your thoughts, observations and views. To reflect further on this subject and others, please respond within Twitter, Facebook and LinkedIn's ATCA Open and related discussion platform of HQR. Should you wish to connect directly with real time Twitter feeds, please click as appropriate:

. ATCA Open

. @G140

. mi2g Intelligence Unit

. Open HQR

. DK Matai

Best wishes