Could Rising Bond Yields Trigger An Equity Market Correction?

London, UK - 5th April 2010, 08:11 GMT

Dear ATCA Open & Philanthropia Friends

[Please note that the views presented by individual contributors are not necessarily representative of the views of ATCA, which is neutral. ATCA conducts collective Socratic dialogue on global opportunities and threats.]

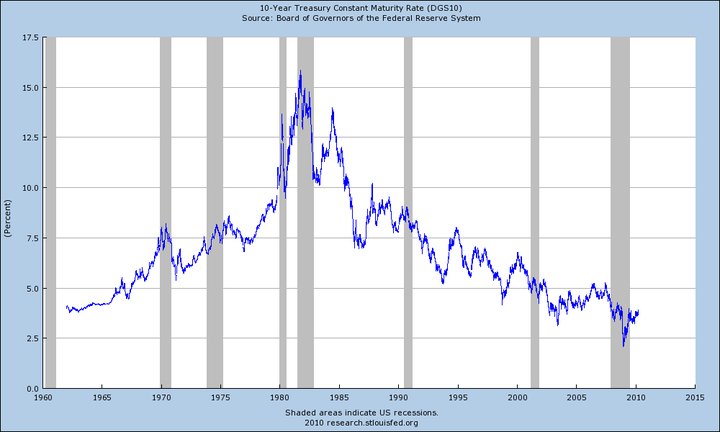

The majority are ignoring what might be the canary in the coal mine -- a rise in interest rates demanded by purchasers of US government bonds. The prospect of a spike in yields in the Treasury market is worth considering as a trigger for an equity market correction. In the past, every equity market correction -- 1987, 1994, 1998, 2000, 2007 and 2008 -- was preceded by what turned out to be a brief but significant spike in yields. The more overvalued the equity market is, the more the downside risks if bonds begin to provide greater yield competition in the near-term. Falling inflation, rising unemployment, the housing market slump, the Federal Reserve’s policies of a near zero overnight borrowing rate and its purchase of up to USD 1.7 trillion in bonds have all helped keep US Treasury yields near historic lows. The Fed has now completed its bond buying programme before Easter, leaving the market to absorb the supply of new debt on its own.

10-year Treasury Yields 1962-2010 Source: US Federal Reserve

10-year Treasury Yields 1962-2010 Source: US Federal Reserve

The Cusp

Long-term bond rates are rising swiftly and it is no coincidence that this has occurred after the passage of the trillion dollar healthcare reform and the end of Fed buy-backs. The 10-year T-notes yield climbed as high as 3.95 percent during the last trading session before Easter, rising to its highest level since June 2009 to approach the psychologically important 4 percent cusp for the first time since 2008. That, in turn, could spook the equity market since another 25 to 50 basis points of upside pressure could then generate a fund-flow spiral as was the case in the summer of 2007. 10-year T-notes last traded above 4 percent in October 2008, just before the global credit crisis peaked and investors poured money into bonds for safety. As a result, by December 2008, bond yields hit generational lows and equity markets carried on falling to reach their lows in March 2009.

Bond Vigilantes

Are the "bond vigilantes" beginning to flex their muscles? The term was coined in the 1980s when bond investors pushed up long-term yields to force central banks into taking action to curb inflation. This time, bond investors may be less worried about inflation: they are more concerned about huge fiscal deficits and the looming bond supply needed to finance them. Concerns about the debt loads of developed economies have come into focus this year amid the crisis threatening smaller members of the Eurozone such as the PIIGS countries in general and Greece in particular. The fact that German Bunds have outperformed both US Treasuries and UK Gilts in recent months highlights this increasing worry over public debt. Germany’s budget deficit is much lower than the US and UK and inflation there is also expected to remain low.

Tipping Point

The environment for debt auctions has turned negative. Three auctions -- of two-, five-, and seven-year US Treasuries -- did not go down well recently, as traditional institutional and sovereign investors sat on the sidelines. That triggered a huge sell-off in US Treasuries. Interest rates carried on rising in the bond market last Friday after the government said employers added jobs in March. Investors often sell Treasuries and favour riskier assets like stocks and commodities when the economy shows signs of improving. This is an additional upward pressure on US Treasury yields until the allocation of capital to equity markets crosses the tipping point.

Facts on US Gov Debt

. The official US national debt now stands at USD 12.7 trillion — an amount equal to 89 percent of US GDP at USD 14.2 trillion.

. Last year, Washington added USD 1.4 trillion to the national debt. In this fiscal year, the Obama administration will add another USD 1.6 trillion. This is the largest deficit as a proportion of GDP since 1945, the last year of World War II. For the fiscal year 2010, borrowing will have to provide 40 percent of all government revenue. The economic crisis has reduced tax revenues by 17 percent, a sharper decline than any other year since 1932, the nadir of the Great Depression.

. In addition to funding the current deficits, the US Treasury must borrow more each year to replace bills, notes and bonds that are maturing.

. This record-shattering borrowing by the US Treasury has resulted in an unprecedented avalanche of Treasury obligations being dumped onto the market, which naturally depresses bond prices and drives interest rates higher with unintended consequences for other asset classes such as equities and commodities.

. In an attempt to keep interest rates low, the US Federal Reserve has created USD 1.7 trillion of new money, via quantitative easing, to buy:

a. USD 1.25 trillion of mortgage-backed securities;

b. USD 300 billion to buy US Treasuries; and

c. USD 170 billion to buy other government bonds.

. From September 2008, just before the Lehman Brothers crisis, to March this year, the Federal Reserve increased the US monetary base from USD 850 billion to USD 2.1 trillion — a 150 percent increase in just 18 months.

. State, county and local governments are nearly USD 3 trillion in debt with rapidly rising budget deficits. Unable to close the gap, they may ultimately demand that Washington DC assume responsibility.

Swaps

For the first time since swaps emerged in the mid-1980s, the US 10-year swap rate traded below that of the theoretically “risk free” 10-year Treasury yield recently. This reflects how prolific government debt issuance has altered the dynamics between “risk-free” yields and swaps, which reflect borrowing costs for private sector, ie, non-sovereign borrowers. In the UK, swap rates have been below those of 10-year gilt yields since January.

Conclusion

US Treasuries constitute the most liquid market in the world and the yield on the 10-year US Treasury note is often used as a benchmark for consumer loans and mortgages. Huge issuance of government debt is beginning to create unexpected distortions and stresses in the bond market. It is far from clear that we have seen the last of them, given the amounts that still need to be raised. A long period of stability in the US government bond market is showing signs of cracking in the last few weeks. For more than a year, it has been clear that record sized debt sales by the US Treasury remain at odds with a 10-year yield sitting comfortably below 4 per cent. All that is about to change. In the process, given the long track record, this may precipitate a significant correction in the equity markets as soon as we arrive at the tipping point.

[ENDS]

We welcome your thoughts, observations and views. To reflect further on this subject and others, please respond within Twitter, Facebook and LinkedIn's ATCA Open and related discussion platform of HQR. Should you wish to connect directly with real time Twitter feeds, please click as appropriate:

. ATCA Open

. @G140

. mi2g Intelligence Unit

. Open HQR

. DK Matai

Best wishes