US No Longer AAA? S&P Downgrades US Debt to AA+

London, UK - 6th August 2011, 08:10 GMT

Dear ATCA Open & Philanthropia Friends

[Please note that the views presented by individual contributors are not necessarily representative of the views of ATCA, which is neutral. ATCA conducts collective Socratic dialogue on global opportunities and threats.]

Standard and Poor's has downgraded the United States' credit rating by one notch from AAA to AA+ for the first time in the history of the ratings, despite a push back from the White House and the US Treasury: They have said the agency's analysis of the US economy was deeply flawed and off by trillions of dollars. This is proving to be a contentious move that highlights the weakened fiscal stature of the world’s most powerful country. To add to America's concerns, the agency has also issued a negative outlook. As a result, there is a chance it will lower the rating further within the next two years. The downgrade:

1. Comes in the midst of great uncertainty and volatility in global financial markets in the last week;

2. Appears to originate from political as well economic analysis and the consequences of the action could be wide-ranging and unpredictable; and

3. Was rumored for weeks during the prolonged debt-ceiling debate in the US Congress but many felt that last week's deal would reduce the chances of such drastic action.

As many decision makers across the world will recall, US Treasury Secretary Tim Geithner said that a downgrade wasn't going to happen. Geithner said that there was no chance that the US would lose its top credit rating. "No risk of that, no risk," Geithner said on one of the leading television business networks in April, 2011.

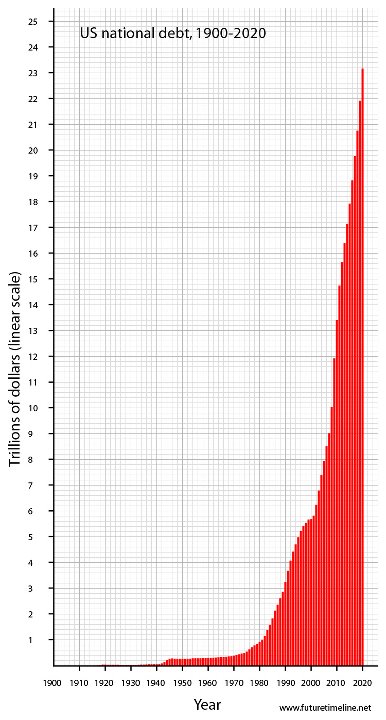

Rising US National Debt

Rising US National Debt

What are the implications of S&P's downgrade of US debt from AAA to AA+?

The official statement from S&P follows:

"We lowered our long-term rating on the US because we believe that the prolonged controversy over raising the statutory debt ceiling and the related fiscal policy debate indicate that further near-term progress containing the growth in public spending, especially on entitlements, or on reaching an agreement on raising revenues is less likely than we previously assumed and will remain a contentious and fitful process. We also believe that the fiscal consolidation plan that Congress and the Administration agreed to this week falls short of the amount that we believe is necessary to stabilize the general government debt burden by the middle of the decade. Our lowering of the rating was prompted by our view on the rising public debt burden and our perception of greater policymaking uncertainty, consistent with our criteria. Nevertheless, we view the US federal government's other economic, external, and monetary credit attributes, which form the basis for the sovereign rating, as broadly unchanged."

What of the row between S&P and the US Government?

The downgrade follows an extraordinary row which stalled the downgrade announcement for hours after the US Treasury department claimed it had found trillions of dollars worth of errors in the credit rating agency’s analysis, which was considered to be fraught with "deep and fundamental flaws" by at least one source close to the discussions.

Could the US regain a AAA rating?

Americans and long term investors in US treasuries may take heart from the examples of Canada and Australia, which both managed to restore their lost "AAA" scores. While some nations have managed to climb back up again to the top of the ratings summit, others have found it extremely difficult to recover this coveted standard-of-excellence. Three European countries were in the exclusive AAA club before being booted out: Ireland (2009), Iceland (2008) and Spain (2010). All three benefited from speculative real estate bubbles that significantly increased tax revenues, until the bubbles burst.

What are the consequences of the loss of AAA?

Different countries exhibit different scenarios:

1. Japan: S&P cut Japan's AAA rating in 2001, and since then the debt-ridden country has descended to AA-. Japan's borrowing costs did not rise immediately after the first cut. This suggests that a US downgrade might not be catastrophic for the value of US treasuries. However, there is a big difference between the US and Japan. Tokyo's lenders are mainly domestic and continue to buy its debt to this day, even though Japan's debt-to-GDP ratio is a colossal 220+ percent, the largest of any country. In America's case, a large proportion of its sovereign debt is held by overseas investors including China and Japan.

2. Ireland -- now rated BBB+ by S&P -- has not been able to tap international credit markets since 2010.

3. Iceland -- now rated BBB- by S&P -- successfully issued bonds only in June this year after three years of no access to commercial credit markets.

4. Spain -- now rated AA by S&P -- is experiencing extreme turbulence in the bond markets because of its debt load. The risk premium on Spanish bonds has shot to a euro-era record of 400+ basis points in comparison to top-notch German bunds.

Conclusion

If the United States does not merit a AAA rating from S&P any more, is there an inenvitable risk to the AAA ratings of a number of other major countries? S&P still has a triple-A rating on the following key nations: Australia, Austria, Canada, Denmark, Finland, France, Germany, Netherlands, Norway, Singapore, Sweden, Switzerland and the United Kingdom. The corollary to this downgrade is that S&P will need to embark on an immediate review of the credit ratings of all the major sovereigns. Is there a risk of pandemonium in the global financial markets as a result of the unilateral change in the AAA credit rating of the US? Which of the other AAA nations are likely to lose their top-notch status?

[STOPS]

We are hosting an Expert roundtable on this issue at ATCA 24/7 on Yammer.

[ENDS]

Expert Roundtables

Expert roundtables are the newly launched ATCA 24/7 Q&A private exclusive club service. They seek to become the killer application in strategic intelligence by delivering an unprecedented competitive advantage to our distinguished members. They can only be accessed online at https://www.yammer.com/atca

Q1: How to become a privileged member of ATCA 24/7 to participate in the expert roundtables?

A1: i. If you are a distinguished member of ATCA 5000, ATCA Open, The Philanthropia or HQR affiliated groups you may be allowed to become a privileged member of this new and exclusive private club.

ii. If you are pre-invited, visit the private intelligence network -- PIN -- by going to https://www.yammer.com/atca [Note: In https:// 's' is for security and encryption]

iii. If you don't have membership of the PIN yet, email the mi2g Intelligence Unit at intelligence.unit at mi2g dot com for an exclusive invitation.

Q2: How to participate in the expert roundtables and get domain-specific strategic intelligence questions answered?

A2: Access the ATCA 24/7 Private Intelligence Network -- PIN -- online and ask or answer a strategic intelligence question, no matter how complex. Receive expert answers within 24 hours or get pointers from:

i. ATCA 5000 experts who are online;

ii. ATCA Research and Analysis Wing; and

iii. mi2g Intelligence Unit.

Q3: Why is the ATCA 24/7 Q&A Exclusive Club special?

A3: ATCA 24/7 has now created an exclusive private intelligence watering hole and expert roundtable at the highest level where interesting and sophisticated questions are being asked from around the world, and intelligent answers are being provided, almost always by experts who have deep domain-specific knowledge. Come and check out the exclusive club, take it for a strategic test drive, which sign-of-intelligent life are you waiting for?

To learn more about "The Expert Roundtable: ATCA 24/7 Q&A Club" email: intelligence.unit at mi2g.com and if you are already a member visit https://www.yammer.com/atca

We welcome your thoughts, observations and views. To reflect further on this subject and others, please respond within Twitter, Facebook and LinkedIn's ATCA Open and related discussion platform of HQR. Should you wish to connect directly with real time Twitter feeds, please click as appropriate:

. ATCA Open

. @G140

. mi2g Intelligence Unit

. Open HQR

. DK Matai

Best wishes