Why

is the LIBOR differential getting larger?

London, UK - 7th December 2007, 09:19 GMT

Dear Open ATCA & Philanthropia Friends

[Please note that the views presented by individual contributors

are not necessarily representative of the views of ATCA, which is neutral.

ATCA conducts collective Socratic dialogue on global opportunities and threats.]

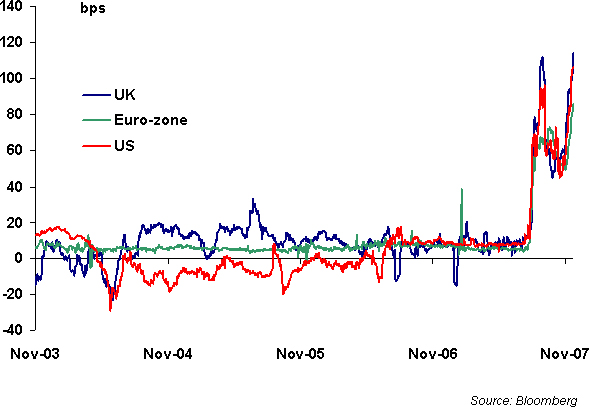

Although the Bank of England has cut base rates by 25 basis

points yesterday to 5.5%, the real challenge lies in the increasing differential

between base rates and LIBOR (London Interbank Offered Rate) for sterling,

euro and dollar in the money markets, pointing to a clear erosion of trust

in interbank lending. Three month sterling LIBOR, which was fixed yesterday

at 6.64%, last peaked in September at a differential of 112 basis points and

the spread this morning stands at 114 basis points (bps). What are your views

in regard to the graph below?

3 month LIBOR - 3 month OIS spread (bps)

[ENDS]

What are your views? Sign

In. We look forward to your further thoughts, observations and

views.

Best wishes

DK Matai,

Chairman, Asymmetric Threats Contingency Alliance (ATCA)

Open

ATCA, IntentBlog,

Holistic

Quantum Relativity Group

LinkedIn,

Facebook,

Ecademy,

Xing,

Spock,

A&B

Blog & QDOS

ATCA: The Asymmetric Threats Contingency

Alliance is a philanthropic expert initiative founded in 2001

to resolve complex global challenges through collective Socratic

dialogue and joint executive action to build a wisdom based global

economy. Adhering to the doctrine of non-violence, ATCA addresses

asymmetric threats and social opportunities arising from climate

chaos and the environment; radical poverty and microfinance; geo-politics

and energy; organised crime & extremism; advanced technologies

-- bio, info, nano, robo & AI; demographic skews and resource

shortages; pandemics; financial systems and systemic risk; as

well as transhumanism and ethics. Present membership of ATCA is

by invitation only and has over 5,000 distinguished members from

over 120 countries: including 1,000 Parliamentarians; 1,500 Chairmen

and CEOs of corporations; 1,000 Heads of NGOs; 750 Directors at

Academic Centres of Excellence; 500 Inventors and Original thinkers;

as well as 250 Editors-in-Chief of major media.

The views presented by individual contributors are not necessarily

representative of the views of ATCA, which is neutral. Please

do not forward or use the material circulated without permission

and full attribution.

Intelligence Unit | mi2g | tel +44 (0) 20 7712 1782 fax +44

(0) 20 7712 1501 | internet www.mi2g.net

mi2g: Winner of the Queen's Award for Enterprise in the category

of Innovation

|