Derivatives Quadrillion Play: How Far Away Are We From A Second Financial Crisis?

London, UK - 23rd March 2010, 15:31 GMT

Dear ATCA Open & Philanthropia Friends

[Please note that the views presented by individual contributors are not necessarily representative of the views of ATCA, which is neutral. ATCA conducts collective Socratic dialogue on global opportunities and threats.]

Warren Buffett famously referred to derivatives as "financial weapons of mass destruction". Derivatives are financial contracts, or financial instruments, whose values are derived from the value of something else, known as the underlying. We have been monitoring the size of the global derivatives play for a few years now, measuring it at USD 1.405 Quadrillion in March 2009. One year later, the Quadrillion Play appears to be winding down, but there's a long way to go yet! In March 2010, the trans-national play of all types of derivatives is down to USD 1.048 Quadrillion, a decline of -25% worldwide. As a result, the global size of the derivatives bubble which was calculated last year at USD 206k per person-on-planet, has fallen to USD 149k per person-on-planet. In parallel, since peaking in the second quarter of 2007, US household wealth is also down by USD 14 trillion. It makes one wonder, how much of the perceived wealth is real, and how much is illusory? "Walls-of-Money" that are no more than leverage, levitating and underpinned by derivatives-based-instruments manifest as complex securities.

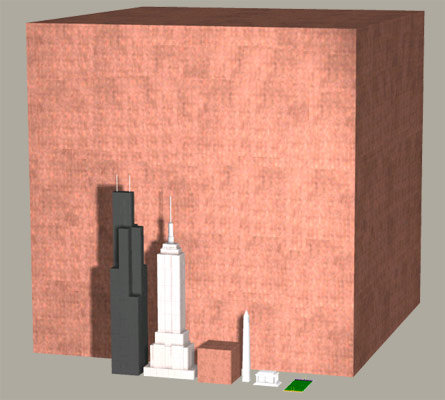

What do a Quadrillion pennies look like?

What do a Quadrillion pennies look like?

What is a Quadrillion? That is a number only supercomputing engineers and astronomers used to use, not economists and bankers! For example, the North star is "just" a couple of quadrillion miles away, ie, a few thousand trillion miles. In the ATCA briefing, "The Invisible One Quadrillion Dollar Equation" published in September 2008, we discussed the main categories of the USD 1.144 Quadrillion derivatives play at that time based on data from various sources including the Bank for International Settlements (BIS) in Basel, Switzerland. By March 2009, the quantum grew significantly in certain crucial categories and the last revised numbers we published, showed the derivatives play at USD 1.405 Quadrillion in March 2009. The latest figures for March 2010 have fallen significantly to USD 1.048 Quadrillion, and tell a rather different story:

1. Over-The-Counter (OTC) derivatives stand in notional or face value at USD 604 trillion (DOWN -39%) for the most recent period ending June 2009 and include:

a. Interest Rate Derivatives at about USD 437+ trillion (DOWN -5%);

b. Credit Default Swaps at about USD 36+ trillion (DOWN -37%);

c. Foreign Exchange Derivatives at about USD 48+ trillion (DOWN -21%);

d. Commodity Derivatives at about USD 3.7+ trillion (DOWN -72%);

e. Equity Linked Derivatives at about USD 6.6+ trillion (DOWN -34%); and

f. Unallocated Derivatives at about USD 72+ trillion (DOWN -11%).

2. Exchange traded or listed credit derivatives volume stands at USD 444 trillion (DOWN -18%) including USD 307 trillion of futures (USD 21.7 trillion outstanding) and USD 137 trillion of options (USD 51.3 trillion outstanding) for the most recent quarter, ie, Q4 2009.

The myth of the single bubble behind The Great Unwind -- manifest as the global credit crunch -- has essentially been dumped in the last few years and subprime mortgage default, a USD 1.5 trillion challenge within the USD 5 trillion mortgage based assets envelope, is seen as a component of a much larger overwhelming global financial crisis with unprecedented scale, speed, severity and synchronicity. That global crisis wiped off a staggering USD 50 trillion off the value of financial assets — currency, equity and bond markets worldwide -- by March 2009, before the global recovery began powered by -- unprecedented and massive -- fiscal and monetary stimulus packages. That recovery is yet to achieve a break even on previous cumulative losses.

The truth is that there are as many as "Eight Bubbles" from our original list and two new "International and Domestic Bond" bubbles at play, including rising sovereign, financial institution, international organisation and corporate debt. The "Ten Bubbles" are in danger of bursting together via interlinkages and domino effects in different geographic zones and sectors. This is understood to a much greater extent now than in the past.

After Lehman Brothers, we went from being able to “rescue the world” with less than USD 1 trillion in October 2008 to USD 11.6 trillion commitments in the US alone, along with a further announcement of USD 1.2 trillion of quantitative easing by the US Federal Reserve in March 2009. By June 2009, the US government and the US Fed had committed USD 13.9 trillion, almost the size of the US GDP. The unwinding timetable has still not been clearly signalled. As time goes by, the full extent of the collateral damage from the Quadrillion Play of derivatives and the interlinked 10 Bubbles is being revealed. The step-by-step bursting process is taking the form of deleverage on an unprecedented scale.

We first discussed “Eight Bubbles” in play worldwide in November 2008 and based on latest information in 2010, the approximate scale of Ten Bubbles" is as follows:

1. Subprime Mortgage linked Loans & Assets (USD 1.3 trillion) within Mortgage backed Assets (USD 5 trillion) and US home mortgage debt (USD 10.5 trillion);

2. China, India, Eastern Europe and other Emerging Market Loans (USD 5 trillion);

3. Commodities (Commodity Derivatives at USD 3.7+ trillion);

4. Corporate bonds (USD 21 trillion) as a subset of all domestic and international bonds;

5. Commercial (USD 22 trillion) and Residential property (USD 41 trillion);

6. Credit Cards Outstanding Debt (USD 4.5 trillion);

7. Currencies (Foreign Exchange Derivatives at USD 48+ trillion);

8. Credit Default Swaps (USD 36+ trillion) as a subset of all Derivatives (USD 1.405 Quadrillion);

to which one must add subsequent large scale bond issues by financial institutions, governments, international organisations and corporate issuers:

9. International bonds and notes - all issuers (USD 26+ trillion); and

10.Domestic bonds and notes - all issuers (USD 51+ trillion).

As of the end of 2009, the size of the worldwide bond market -- total debt outstanding in such instruments -- is an estimated USD 82 trillion.

The relative scale of the world's financial engine is as follows:

1. The entire GDP of the US is about USD 14 trillion.

2. The entire US money supply is also about USD 14 trillion with rising Quantitative Easing in trillions.

3. The GDP of the entire world is USD 45 trillion. USD 1.048 Quadrillion is 23 times world GDP.

4. The real estate of the entire world is valued at USD 60+ trillion, including home equity in the US, which was valued at USD 13 trillion at its peak in 2006, and dropped to USD 8.8 trillion by mid-2008 and is still falling.

5. Total retirement assets, Americans' second-largest household asset, dropped by 22%, from USD 10.3 trillion in 2006 to USD 8 trillion in mid-2008.

6. The world stock markets and related investments are valued at about USD 75 trillion.

7. The trans-national universal model financial institutions own about USD 150 trillion in derivatives at market value.

8. The population of the whole planet is around 7 billion people. So the derivatives market represents about USD 149,000 per person on the planet.

Early in the last decade, a "Giant Pool of Money" -- represented by USD 70 trillion in worldwide fixed income investments -- sought higher yields than those offered by government bonds. Further, this pool of money had roughly doubled in size from 2000 to 2007 to reach USD 140+ trillion, yet the supply of relatively safe, income generating investments had not grown as fast. Investment banks on Wall Street in New York and elsewhere within European financial centres -- London, Frankfurt, Paris, Zurich, Madrid and Milan -- answered this demand with many flavours of structured finance packages, which were assigned safe ratings by the credit rating agencies, and sold on.

The entire derivatives-based structured finance pyramid can keel over when the asset prices begin to decline and as a result, some of the counter-parties are unable to meet obligations. As an example, by September 2008, average US housing prices had declined by over 20% from their mid-2006 peak. As prices declined, borrowers with Adjustable-Rate Mortgages (ARMs) could not refinance to avoid the higher payments associated with rising interest rates and began to default. During 2007, lenders began foreclosure proceedings on nearly 1.3 million properties, a 79% increase over 2006. This increased to 2.3 million in 2008, an 81% increase versus 2007. By August 2008, 9.2% of all US mortgages outstanding were either delinquent or in foreclosure. By September 2009, this had risen to 14.4%. This has had a dramatic effect on almost all real estate structured finance products, including those based on derivatives. The window of opportunity and open market for such product has mostly shut down, leaving enormous black holes on balance sheets of financial institutions and other investment vehicles. Central banks have tried to purge the black holes and have only been partially successful.

Conclusion

The USD 1.048 Quadrillion Play of derivatives remains colossal at 23 times world GDP. Even if 1% of the derivatives pyramid loses counterparties because they have become insolvent, that is more than 10 trillion dollars of a black hole. If that 1% becomes 5%, that is more than 50 trillion dollars, ie, more than the GDP of the entire world.

Over-The-Counter (OTC) derivatives are not traded on an exchange and there is no central counterparty. Therefore, they are subject to counterparty risk, like an ordinary contract, since each counterparty relies on the other to perform. This means that the failure of one major financial institution can cause the evaporation of assets for many other financial institutions that have derivative products with exposure to that one financial institution. When the notional values of a good percentage of financial derivatives start evaporating into thin air, and this can happen as underlying assets lose their value, this has a negative domino effect on and off the balance sheet of not just one major financial institution, but many.

Given that the value of a derivative is contingent on the value of the underlying, the notional value of derivatives has been traditionally recorded off the balance sheet of an institution, although the market value of derivatives has been recorded on the balance sheet. When the Financial Accounting Standards Board (FASB) suspended mark-to-market accounting rules recently, major international banks were allowed to re-value some of their derivative products closer to their notional value on their books to pad their balance sheets. This made them appear healthier than they were. Many argue that only the market value of derivatives, and not their notional value, is ultimately important. This would have only been valid if FASB hadn’t suspended mark-to-market accounting rules!

The market value of financial derivatives is only a fraction of their Quadrillion Play; however the reality is that the potential losses from derivatives gone bad can also be much more than their notional value! For example, some of the derivative products most likely to continue to blow up are Credit Default Swaps (CDS). Remember that it was AIG’s exposure to Credit Default Swaps that caused it to collapse.

Since it is now likely that the balance sheets of many financial institutions have been quickly “nursed back to health” by returning the book value of certain financial derivative products to some notional value versus their true market value, the collapse of the notional value of the Quadrillion Play derivative market could indeed have future devastating consequences for global economies.

The possibility of a house of cards collapse is still very much on the table, and should one begin, the flexibility of governments to avert it will have been reduced by the enormous debt they've run up trying to paper over the first wave of The Great Unwind and The Great Reset. The prudent investor, while earnestly hoping nothing like this comes to pass, should bear in mind that there is a rising probability that it might, and take appropriate precautions. Governments, for their part, ought to require far greater transparency of off-balance-sheet positions so that the nature and extent of risks can better be known to policy makers, regulators as well as private investors.

[ENDS]

We welcome your thoughts, observations and views. To reflect further on this subject and others, please respond within Twitter, Facebook and LinkedIn's ATCA Open and related discussion platform of HQR. Should you wish to connect directly with real time Twitter feeds, please click as appropriate:

. ATCA Open

. @G140

. mi2g Intelligence Unit

. Open HQR

. DK Matai

Best wishes