Beyond The Tipping Point: Setting

the Stage for Weimar?

Metamorphosis in 2009/2010

London, UK - 23rd December 2008, 02:19 GMT

Dear ATCA Open & Philanthropia Friends

[Please note that the views presented by individual contributors

are not necessarily representative of the views of ATCA, which is neutral.

ATCA conducts collective Socratic dialogue on global opportunities and threats.]

Will the "zero interest rate policy" help the US

economy recover? Or will it make matters worse? In recent weeks the US Federal

Reserve has dramatically enlarged its role in the functioning of the financial

markets. It has even taken over the role that was the original purpose of

the Treasury's USD 700 billion Troubled Asset Relief Program (TARP). The

difference between a Fed bailout of troubled financial institutions and

a Treasury bailout is that central bank loans do not have the oversight

safeguards that US Congress imposed upon the TARP. The total of such emergency

Fed lending exceeded USD 2 trillion on November 6th. It had risen by an

astonishing 138 percent, or USD 1.23 trillion, in the 12 weeks since September

14th, when the central bank governors relaxed collateral standards to accept

securities that were not rated AAA. They did so knowing that on the following

day a dramatic shock to the financial system would occur.

On September 15th, Federal Reserve Chairman, Ben Bernanke, New York Federal

Reserve President, Tim Geithner -- the new Obama Treasury Secretary-designate

-- along with the Bush Administration led by Treasury Secretary, Henry Paulson,

agreed to let the fourth largest investment bank, Lehman Brothers, go bankrupt,

defaulting on billions of dollars worth of derivatives and other obligations

held by investors around the world. That event, as is now widely accepted,

triggered a global systemic financial panic as it was no longer clear to

anyone what standards the US Government was using to decide which institutions

were 'too big to fail' and which were not. Since that fateful decision,

the US Treasury Secretary has reversed his policies on bank bailouts repeatedly,

leaving markets confused as to whether he and the Bush Administration had

any coherent strategy for management of the continuing crises in credit

markets, or whether their actions simply represented improvisation in fighting

fires one at a time.

On November 7th, Bloomberg filed a law suit under the US Freedom of Information

Act (FOIA) requesting details about the terms of eleven new Federal Reserve

lending programmes created during the deepening financial crisis.

On December 8th, the Fed denied this request on the grounds that details

of its actions would reveal 'trade secrets' and 'commercial information'

about the recipients of its actions. Thus, the Fed has bluntly refused to

disclose the recipients of more than USD 2 trillion of emergency loans from

US taxpayers, and refused to reveal the assets the central bank is now accepting

as collateral. This has left markets uncertain as to what the Fed's ultimate

objective might be, or even whether there was any consistent strategy underlying

the Fed's continuous stream of innovative lending facilities and purchases

of asset backed securities. Questions are now being raised as to whether

the Fed's unprecedented expansion of the monetary base in recent weeks might

set the stage for a future Weimar-style hyperinflation in 2009/2010.

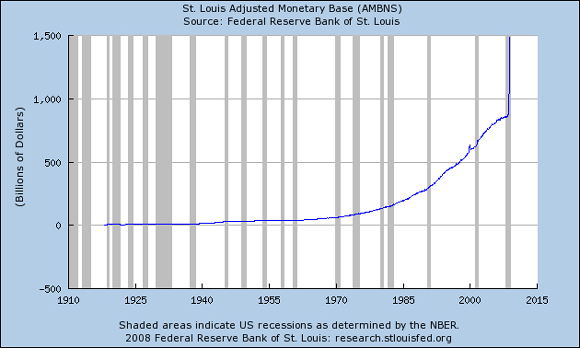

In response to the widening credit market crises and signs of deepening

recession, the US Fed is expanding what is technically called the Monetary

Base, defined as total bank reserves plus cash in circulation, the basis

for potential further high-powered bank lending into the economy. Since

the Lehman Brothers default, this money expansion rose dramatically by end

October at a year-on-year rate of growth of 38%. This has been without precedent

in the 95 year history of the Federal Reserve since its creation in 1913.

The previous high growth rate, according to Fed data, was 28% in September

1939, as the US was building up industry for the evolving war in Europe.

This leaves market analysts worried about whether the American economy is

confronted with deflation or inflation, or even worse, a period of deflation

soon followed by hyperinflation generated by the hyperactive expansion of

the monetary base and the Fed's balance sheet. In parallel, US government

borrowing has spiked -- up from an annualised rate of USD 310bn in the second

quarter of this year to an astonishing USD 2+ trillion at present and rising.

Both US fiscal and monetary policy now seem wildly expansionary, to an extent

never seen before. The present course of Fed policy seems likely to continue

at least until a new Administration takes office. At that time, President

Obama will have the opportunity to shape his own fiscal stimulus package

but also to appoint a number of new Governors of the Federal Reserve, whose

opinions could prove crucial in shaping the Fed's actions early next year.

Up until now, President-elect Obama has declared that he wants the US Congress

to enact a major fiscal stimulus package of a little less than USD 1 trillion.

He has not explained what he would hope the Fed might do in parallel with

his fiscal plans.

Whether the threat of deflation is converted into hyperinflation may thus

depend upon decisions taken in Washington, DC, in coming weeks. We already

have some insight into the potential dangers when we consider the case of

the Weimar Republic. In 1920, Germany experienced a deflationary collapse,

with the average citizen finding it harder and harder to get enough money

for necessities. Banks, short of money, could not honour cheques, and businesses

were strapped for cash to buy materials and meet payroll. Fearing a collapse

that would throw millions of workers out on the street, the German government

desperately printed money in an attempt to re-inflate the economy. During

this period, despite the government's money printing, the Reichmark actually

gained in value against foreign currencies, so that prices of imported goods

fell by some 50%. Eventually, as a result of the money supply's rapid expansion,

the nation's massive foreign debt, and shrinking economy, German citizens

lost all confidence in their currency, and the Weimar Republic experienced

one of the worst cases of hyperinflation in modern economic history in 1923/1924.

As a result, with no countries to competitively devalue against, even the

Weimar hyperinflation failed to achieve its goal, resulting only in the

worldwide slide into recession that culminated in competitive devaluations

in all countries to achieve the inflation against gold that was necessary

to start the recovery. [Reference ATCA: Bretton Woods II]

If we examine the US monetary base -- all paper dollars and coinage in existence

-- it took two centuries for the monetary base to go from USD 0+ to USD

800 billion, but in just the past 3-months it has nearly doubled -- growing

from around USD 800 billion to USD 1.5 trillion -- and by the time we look

closely again in 2009 it will probably have surpassed USD 2 trillion. That

is double the number of paper dollars in existence since last summer! Moreover,

until September 2008, the month of the Lehman Brothers collapse, the Federal

Reserve had held the expansion of the Monetary Base virtually flat. The

76% expansion has almost entirely taken place within the past three months,

which implies an annualised expansion rate of more than 300%.

Despite this, banks continue to be unwilling to lend further.

As pointed out by the some of the top economists at the Federal Reserve

Bank of Minneapolis [Working Paper Number 666], it is not at all clear that

bank lending is the problem, as even the Federal Reserve Board's indicators

of bank lending show little or no significant decline. Hence, the US economy

is in a depression free-fall of a scale not seen since the 1930s. Banks

do not lend in part because under Basel-II -- Bank for International Settlements

(BIS) -- lending rules, they must set aside 8% of their capital against

the value of any new commercial loans. Yet the banks have no idea how much

of the mortgage and other troubled securities they own are likely to default

in the coming months, forcing them to raise huge new sums of capital to

remain solvent. It is far 'safer', they reason, to pass on their toxic waste

assets to the Fed in return for earning interest on the acquired Treasury

paper they now hold. Bank lending is risky in a depression. Banks are also

well aware that their off balance sheet exposure is far larger than their

on balance sheet positions. As Prof Joseph Mason pointed out in his recent

ATCA submission, the off balance sheet exposure of FDIC insured banks is

now an extraordinary multiple of 16 times their on balance sheet positions.

There can be little doubt that the off balance sheet positions are primarily

constituted of troubled assets, since if there were any high quality assets

in those structured vehicles they would have long since been brought back

onto the balance sheets of troubled banks.

American banks have exchanged USD 2 trillion of presumed toxic waste securities

consisting of Asset-Backed Securities in sub-prime mortgages, stocks and

other high-risk credits in exchange for Federal Reserve cash and US Treasury

bonds or other Government securities still rated AAA, ie, risk-free. The

result is that the Federal Reserve is holding some USD 2 trillion in largely

junk paper from the financial system. The banks benefiting from the Fed's

actions naturally oppose any release of information because that might signal

'weakness' and spur short-selling, selling or a run by depositors - whether

or not they are appropriate in doing so.

To replace wholesale deposits with retail deposits is a process that in

the best of times will take years, not weeks. Understandably, the Federal

Reserve does not want to discuss this. That is clearly also behind their

blunt refusal to reveal the nature of their USD 2 trillion assets acquired

from member banks and other financial institutions. Simply put, were the

Fed to reveal to the public precisely what 'collateral' they held from the

banks, the public would know the potential losses that the government may

take. Even though the Fed does not reveal the details, the very act of omission

is an implicit confession that there are more toxic assets hidden than they

would care to have revealed at this stage.

Making the situation even more drastic is the banking model used first by

US banks beginning in the late 1970s for raising deposits, namely the acquiring

of 'wholesale deposits' by borrowing from other banks on the overnight interbank

market. The collapse in confidence since the Lehman Brothers default is

so extreme that no bank dares trust any other bank enough to borrow. The

US Federal Deposit Insurance Corporation is currently considering an additional

regulatory tax on Brokered Deposits, placed in sound banks by knowledgeable

brokers, confusing liability risk with asset risk. That leaves only traditional

retail deposits from private and corporate savings or checking accounts.

On December 10th, in Congressional hearings by the House Financial Services

Committee, Representative David Scott, a Georgia Democrat, said Americans

had 'been bamboozled,' slang for defrauded. Several members of the US Congress

are now demanding more transparency from the Federal Reserve and US Treasury

on bailout lending. US Fed Chairman Ben Bernanke and Treasury Secretary

Henry Paulson said in September they would meet Congressional demands for

transparency in a USD 700 billion bailout of the banking system.

In early December the US Congress oversight agency, GAO, issued its first

mandated review of the lending of the US Treasury's USD 700 billion TARP

program (Troubled Asset Relief Program). The review noted that in 30 days

since the programme began, Henry Paulson's office had handed out USD 150

billion of taxpayer money to financial institutions with no effective accountability

of how the money is being used. It seems Henry Paulson's Treasury has indeed

thrown a giant 'tarp' over the entire taxpayer bailout.

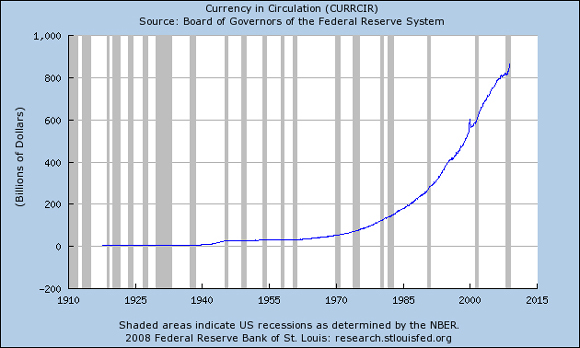

The next chart is "Cash in Circulation". So far only a small amount

of all that extra currency has leaked out of the banking system and into

circulation. But one can assume that at some stage it will begin to do that

more excessively. When it does, it means that prices must rise to soak up

all that extra currency, like a sponge which soaks up liquidity. This could

be bad news for someone holding cash US dollars, but cause for celebration

for those holding physical assets such as houses, land or precious metal.

The two spikes are illustrative of the massive infusions of cash the Fed

has relied upon in righting recent recessions of 2001 and 2007/2008 (thus

far).

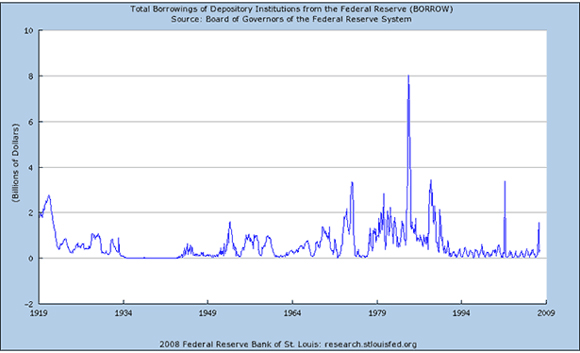

Here is a chart of how many dollars the banks have borrowed

from the US Federal Reserve through the end of last year (2007). Please

note the spike that indicates the banks had to borrow USD 8 billion from

the Federal Reserve during the Savings and Loan (S&L) Crisis of the

late 1980s.

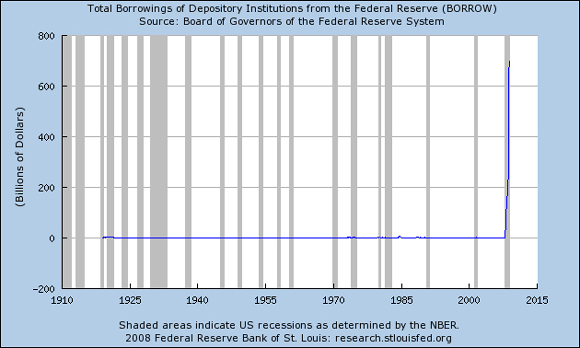

Here is the same chart, but ATCA RAW has now taken it out

to the beginning of November 2008. One cannot even see the USD 8 billion

S&L crisis peak anymore! In fact, the banks are approaching USD 800

billion in borrowings. This means that the central banking system already

perceives this crisis as being 100 times larger than the S&L crisis.

In terms of policy response, this is already about on par with that in the

Great Depression. For example, the Reconstruction Finance Corporation's

USD 50 billion (1937 dollars) in real dollar terms today, amounts to between

USD 600b and USD 7.5 trillion depending on inflator.

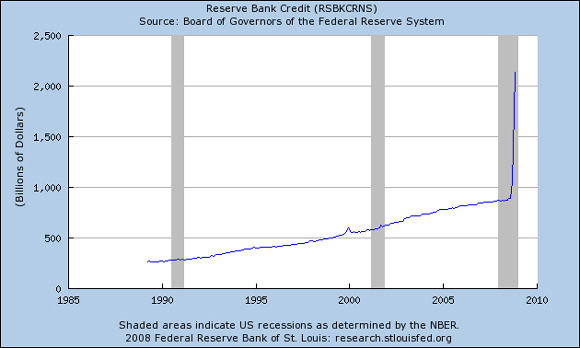

This next chart is Reserve Bank Credit. It is the total amount

the Federal Reserve has loaned out of its theoretically infinite check book,

ie, bank borrowing. This chart includes all the rest of the bailouts (at

least to the beginning of November 2008). This chart also rises to roughly

USD 800 billion by the end of 2007, but by the start of November 2008, it

has risen to USD 2.2 trillion.

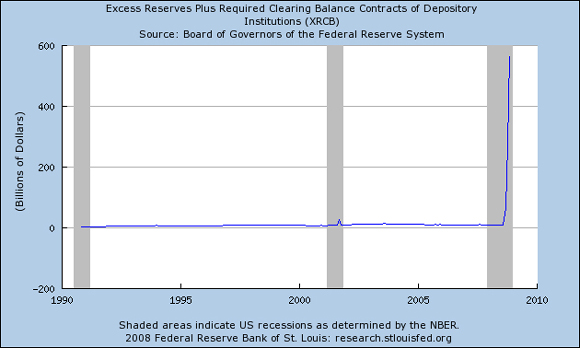

Finally, ATCA has a chart of "Excess Bank Reserves".

These are reserves in excess of the amount that the Federal Reserve requires

the banks to have. It looks almost identical to the chart of Bank Borrowings,

except for two small features; there is a tiny blip in 2001 and a small

bump around 1941. It would imply that the banks perceive this crisis to

be 50 times larger than 9/11 or even World War II.

All graphs in this article have been sourced from the US Federal

Reserve Bank (of St Louis). These charts raise the question of whether in

a few years a chart of the price of physical assets like land and precious

metals including gold might look similar to these charts. In such a case,

would the chart of the purchasing power of the US dollar look like one of

these charts flipped upside-down?

Under the euphemism of "quantitative easing", the Fed appears

to be printing trillions of dollars, using them to buy up mortgage debt,

credit card debt and other junk securities the private sector does not want.

The Fed's actions are evidently designed to avert deflation. The question

must, however, be asked whether the Fed's current actions will inevitably

bring about a surge of Weimar Republic-style inflation. Is the Fed "lubricating"

the system, or is it flooding the engine of the US economy with so much

cash that the ultimate outcome will be a hyper-inflated recovery, characterised

by hyperinflation and anaemic economic growth?

The Fed's actions have driven the yield on the 30-year US bond down to 2.6

percent -- the lowest for 50 years. This Fed may be determined to maintain

such a low yield for a prolonged period, but in the event that the markets

ultimately become overwhelmed with the Fed's printing presses, the yield

could take off in the midst of an economic blood-bath. It may be asked whether

such low yields suggest the US Treasuries market could perhaps be moving

into bubble territory. The Fed has committed itself to buying long-term

US government debt in huge quantities. But, as America's liabilities rise

and the printing presses keep rolling, there will increasingly be risk that

the dollar will fall. If that were to happen, the argument for holding US

Treasuries would collapse! The danger is now rising that, in the near future,

the only net buyer of US Treasuries could be the Fed itself. Very serious

questions would then be asked about America's ability to service its debt.

Would foreign creditors remain passive in such a challenging situation?.

This scenario is alarming, but far from impossible. It is apparent that

the Fed believes it is fighting deflation. But its argument and modus operandi

raises questions. As measured by the pre-Clinton methodology, before the

politicians started messing with the numbers -- inflation stands at +4.5

percent. Is that inflation or deflation at present? Deflation is clearly

being used as a basis to print money in an effort to bury mistakes -- past

policy errors -- and bail out Wall Street. US regulators have undertaken

a massive policy of forbearance in recent years, and many banks need to

be closed. The inflationary stance is therefore currently being used to

patch over those shortcomings without really closing insolvent banks and

recapitalising others.

The Federal Reserve's actions since September suggest signs of panic. The

new money is not being 'sterilised' by offsetting actions by the Fed, a

highly unusual move suggesting a degree of desperation. Prior to September,

the Fed's infusions of money were sterilised, making the potential inflation

effect 'neutral.' This means once banks begin finally to lend again, perhaps

in a year or so, the lack of sterilisation will flood the US economy with

liquidity in the midst of a deflationary depression. At that point or perhaps

well before, depending upon the economic and monetary policies of other

governments around the world, the dollar could collapse as foreign holders

of US Treasury bonds and other assets run. Such a scenario would result

in a sharp appreciation in the euro and a crippling effect on exports in

Germany and elsewhere should the nations of the EU and other non-dollar

countries such as Russia, OPEC members and, above all, China not have arranged

a new zone of stabilisation apart from the dollar.

On December 15th, Bloomberg reported -- Dollar Staggers as US Unleashes

Cash Flood: "US policy makers are flooding the world with an

extra USD 8.5 trillion through 23 different plans designed to bail out the

financial system and pump up the economy."

In the present circumstances, with the government and the central bank taking

a growing role in the functioning of credit markets -- and even in the functioning

of industry -- it is not surprising that people in the Western world are

finding it difficult to trust their banks. Is money safe in a bank? If gut

feeling suggests "No", one might be right. Remember, we don't

have physical asset backed money in the bank, we only have a number on a

computer screen. This time around, there is no commitment to re-establish

the "Gold Standard" and no intent to even try to return to pre-crisis

parity, even if that could be judged as theoretically correct.

Right now, the US Federal Reserve, and the Western banking system in general

seem to be gearing up for an event the type of which we have never before

seen. ATCA RAW and the mi2g Intelligence Unit are of the view that the crisis

that will unfold over the next few years could potentially add up to the

biggest economic event in history. The scale of what has happened and will

happen may dwarf all other economic events combined. The Tulip mania of

1637, John Law's "Mississippi Scheme" of 1720, and the dotcom

bubble of 1999/2000 are all set to pale in comparison. Even the hyperinflation

in Weimar Germany in 1923/24 and the 1930s Great Depression which followed

the stock market crash in 1929 may be inappropriate comparisons.

The world faces the greatest financial and economic challenge in history

in coming months. The incoming Obama Administration may find itself with

a choice of literally nationalising the credit system to insure a flow of

credit to the real economy over the next 5 to 10 years, or to face an economic

Armageddon that will make the 1930s appear to be a milder event by comparison.

For the week ended December 6th, initial jobless claims in the US rose to

the highest level since November 1982. More than four million workers remained

on unemployment, also the most since 1982 and in November US companies cut

jobs at the fastest rate in 34 years. Some 1,900,000 US jobs have vanished

so far in 2008.

As a matter of relevance, 1982, for those with long memories, was the depth

of what was then called the Volcker Recession. Paul Volcker, a Chase Manhattan

alumnus of the Rockefeller family institution, had been brought down from

New York to apply his interest rate 'shock therapy' to the US economy in

order as he put it, 'to squeeze inflation out of the economy.' He squeezed

far more as the economy went into severe recession, and his high interest

rate policy detonated what came to be called the Third World Debt Crisis.

The same Paul Volcker has just been named by Barack Obama as Chairman-designate

of the newly formed President's Economic Recovery Advisory Board.

Virtually every time governments, and/or the banking system, abuse a fiat

paper currency enough to push it to a tipping point (such as in these charts),

the free market and the will of the public revalue gold and silver as well

as land to account for the excess currency that was created since the last

time they were revalued. But this time, for history to repeat, and for gold

to do what it did in 1980, 1934, and hundreds of times throughout history

going all the way back to ancient India, Greece and Rome, it will require

a gold price of over USD 10,000 per ounce from today's USD 800+. That is

if they stop printing US dollars today!

The present economic collapse across the United States is driven by the

collapse of the several trillion dollars market for high-risk sub-prime

and Alt-A home mortgages and other forms of securitised debt, superseded

by the eight bubbles outlined within ATCA. Fed Chairman Bernanke is on record

stating that the worst should be over by end of December, but there seems

little reason to make such a judgement. The same Bernanke stated in October

2005 that there was "no housing bubble to go bust." Moreover,

once the residential mortgage market blew up, he assured that the problem

would be "contained." So much for his predictive acuity. The widely-used

S&P Schiller-Case US National Home Price Index showed a 17% year-on-year

drop in the third quarter with a rising trend. On present estimates it could

take as long as another five to seven years to see US home prices reach

bottom. However, if hyperinflation should manifest, house prices will start

rising dramatically. In 2009 as interest rate resets on some USD 1 trillion

worth of Alt-A US home mortgages begin to kick in, the rate of home abandonments

and foreclosures could potentially explode. Little in any of the so-called

mortgage amelioration programmes offered to date reaches the vast majority

affected.

The definition of Depression was recently published, a term that was deliberately

dropped after World War II from the economic lexicon as an event not repeatable.

Since then all downturns have been termed 'recessions.' Per the US economic

authorities at the Commerce Department's Bureau of Economic Analysis and

at the National Bureau of Economic Research (NBER), as well as numerous

private sector economists, the more precise definitions of 'recession,'

'depression' and 'great depression' follow. The official NBER definition

of recession is, "Two or more consecutive quarters of contracting real

GDP, or measures of payroll employment and industrial production."

"A depression," is defined, "as a recession in which the

peak-to-bottom growth contraction is greater than 10% of the GDP."

"A Great Depression," is defined as, "one in which the peak-to-bottom

contraction exceeds 25% of GDP."

In the period from August 1929 until he left office in January 1934 President

Herbert Hoover oversaw a 43-month long contraction of the US economy of

33%. Is it conceivable that Barack Obama might break that record, and preside

over what historians might end up calling the Very Great Depression of 2008-2014?

What is needed is a radically new strategy to put virtually

the entire United States economy into some form of an emergency 'Chapter

11' bankruptcy reorganisation where banks take write-offs of up to 90% on

their toxic assets, that, in order to save the real economy for the American

population and the rest of the world. Paper money can be shredded easily.

Not human lives. In the process it might be time for the US Congress to

consider retaking the Federal Reserve into the Federal Government as the

Constitution originally specified, and make the entire process easier for

all.

The Risk of Sudden Collapse of All Capital-Based Pension Systems

The Fed's relentless effort to suppress long-term yields could generate

yet another crisis affecting the future years of the majority of the working

population. By April 2009, the general public will become aware of three

major destabilising processes beyond the scale, speed, severity and synchronicity

of the present global downturn, which are linked to the next leg of The

Great Unwind:

. Time Horizon: The full length and end-point of the crisis will become

more (and not less) elusive to determine;

. Unemployment: Major increase of unemployment in millions per month per

major G7 country and worldwide with attendant social unrest; and

. Sudden Collapse: The risk of sudden collapse of all capital-based pension

systems as the value of annuities and paper assets erodes.

Among the various consequences of the crisis for tens of millions of people

in the G7 -- US, Japan, EU-4, and Canada -- from the end of this year and

starting early in 2009, news about major losses on the part of the organisations

in charge of managing the financial assets that finance pension annuities

could multiply.

The OECD anticipates that pension funds have lost USD 4 trillion in 2008

already. In the Netherlands as well as in the United Kingdom, monitoring

organisations recently blew the whistle asking for an emergency contribution

reappraisal and a state intervention. In the United States, growing numbers

of announcements call for contribution increases and benefit reductions,

knowing that it is only in a few weeks time that most of these pension funds

will start calculating their total losses.

Most of the pension systems are still deluding themselves about their capacity

to build up their capital base again after the markets turn around. In March

2009, when pension fund managers, pensioners and governments will become

simultaneously aware of the fact that the crisis is there to last, that

it coincides with the baby-boomer generation's age of retirement and that

the markets will not resume their 2007 levels until many long years to come,

chaos will flood this sector and governments will reach the moment when

they may be compelled to nationalise all these funds. Surprisingly, Argentina,

which took this decision a few months ago already, may appear to have been

a pioneer!

Metamorphosis

Numerous Western government have been preparing their domestic security

systems precisely for the unfolding consequences of The Great Unwind projected

by April 2009, as the establishment expects backlash, ie, domestic violent

unrest when people become frustrated with the economic crisis and cross

the tipping point, much like what has happened in Greece. A whole range

of psychological factors are contributing to this tipping point: people

are starting to become aware in Iceland, the Euroland (especially Greece,

Ireland, Portugal and Spain), UK, America and Asia that this trans-national

crisis has escaped from the control of every public authority, whether national

or international; that it is severely affecting all regions of the world,

even if some are affected more than others; that it is directly hitting

hundreds of millions of people in the "developed" and "emerging"

world; and that it is only worsening as its consequences reveal themselves

throughout the real economy.

National governments and international institutions may have only a few

months left to prepare themselves for the next blow, post the reconciliation

of books and numbers in Q1 2009, one that could go along severe risks of

social chaos. The countries which are not properly equipped to cope with

a surge in unemployment and major risks on pensions' capitalisation will

be seriously destabilised by this new public awareness. Especially countries

which are running digital exchange economies, based on a lot of numbers

that could end up meaning nothing in the event of black holes like Madoff

and collapses in the market value of major assets held across the eight

bubbles.

All the trends tracked are already at work. Their combination, together

with growing public awareness of their potential consequences, will likely

result in the great collective psychological trauma of 2009/2010, when everyone

will realise that we are all trapped into a crisis worse than in the 1930s.

That there is no possible way out in the short-term. The impact on the world's

collective mentalities of people and policy-makers will be decisive and

modify significantly the course of the crisis in its next stage. Based on

greater disillusionment and fewer beliefs in the trust-me system, social

and geo-political instability may unleash a number of black swan events

that could compound the challenges for governments and social organisations

as we know them.

It is worth remembering that asset-backed real wealth is never destroyed

-- it is merely transferred into another form. What form will wealth take

in its new manifestation?

[ENDS]

ATCA Open maintains a presence for Socratic Dialogue and feedback on Facebook,

LinkedIn

and IntentBlog.

We welcome your thoughts, observations and views. Thank you.

Best wishes