Vast, Highly Accommodative $2.6+ trillion Quantitative Easing (QE) to End?

London, UK - 24th June 2013, 10:45 GMT

Dear ATCA Open & Philanthropia Friends

[Please note that the views presented by individual contributors are not necessarily representative of the views of ATCA, which is neutral. ATCA conducts collective Socratic dialogue on global opportunities and threats.]

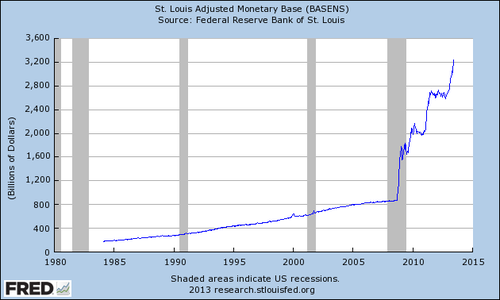

An unprecedented monetary policy so supportive of US and global recovery has now begun to turn, as indicated recently by the Federal Reserve chairman Ben Bernanke. The step-by-step halt and exit from this type of multi-trillion-dollar QE remains untried and untested, so we remain in totally uncharted waters in regard to unintended consequences. Is there huge market volatility next? Most probably, yes! Just watch the long term interest rates rising as there was no real sterilisation of this massive injection of money supply in trillions of dollars over the last five years on top of the $800+ billion total Federal Reserve balance sheet inherited in March 2008. [See Federal Reserve chart and note ATCA 5000 briefing: "Why The End of QE May Be Imminent? Faith, Trust and Pixie Dust"]

US Federal Reserve Balance Sheet

US Federal Reserve Balance Sheet

When looking at the massively exploded $3.41 trillion US Fed balance sheet as of June 2013, one can easily forget that in about 100 years, the Fed only printed $800+billion up until March 2008. [See Federal Reserve chart] Now the Fed balance sheet stands at more than four times the initial figure: most of it is outstanding debt and not all of it is high grade. What are the real long term consequences of this financial DNA-altering experiment, with all manner of impurities added, and are we just about to read the opening verse in the first chapter via the financial markets?

What are those swiftly rising interest rates in the long term -- as measured on ten year and thirty year government bonds -- really stating? In numbers, are they suggesting that inflation could steadily ratchet upwards and begin to go out of control?

Weimar oder Zimbabwe? Perhaps neither in the very short term because the south pointing resistance vectors to the velocity of money are still many to impede a northerly rocket-style take off into the stratosphere of super-inflation. However, the fear amongst sophisticated investors is that official inflation statistics may be artificially subdued and may therefore never indicate hyperinflation ahead, which can happen very very quickly as was the case in Weimar and also in Zimbabwe. [Note ATCA 5000 briefing: "Massive QE: Death by Insulin Overdose?"]

Ultimately, all fiat currency can become a license-to-thrill, a play on national debt, and a confidence trick. In this case it has been levitated, contrary to popular opinion, via massive QE. What happens if confidence evaporates when massive QE is switched off? We may witness not just equity markets volatility but currency and bond markets volatility simultaneously. It is not easy to give up on such a massive drug addiction without severe withdrawal symptoms including violent trembling, severe pain and suffering. Note, if extreme volatility carries on, it can become synonymous with further confidence and structural corrosion.

All this means in a nutshell is that QE could carry on for a lot longer than originally envisaged until the bond market volatility puts an end to it. When it is eventually switched off, beware the consequences. It is a colossal elephant in the room getting $85 billion larger every month and nobody is really looking at the Fed's balance sheet whose humongous size has crossed $3.41 trillion and is still rising! Is it now time to 'stress test' the Fed, the ultimate large cap financial institution, before it is too late?

[STOPS]

What are your thoughts, observations and views? We are hosting an Expert roundtable on this issue at ATCA 24/7 on Yammer.

[ENDS]

Expert Roundtables

Expert roundtables are the newly launched ATCA 24/7 Q&A private exclusive club service. They seek to become the killer application in strategic intelligence by delivering an unprecedented competitive advantage to our distinguished members. They can only be accessed online at https://www.yammer.com/atca

Q1: How to become a privileged member of ATCA 24/7 to participate in the expert roundtables?

A1: i. If you are a distinguished member of ATCA 5000, ATCA Open, The Philanthropia or HQR affiliated groups you may be allowed to become a privileged member of this new and exclusive private club.

ii. If you are pre-invited, visit the private intelligence network -- PIN -- by going to https://www.yammer.com/atca [Note: In https:// 's' is for security and encryption]

iii. If you don't have membership of the PIN yet, email the mi2g Intelligence Unit at intelligence.unit at mi2g dot com for an exclusive invitation.

Q2: How to participate in the expert roundtables and get domain-specific strategic intelligence questions answered?

A2: Access the ATCA 24/7 Private Intelligence Network -- PIN -- online and ask or answer a strategic intelligence question, no matter how complex. Receive expert answers within 24 hours or get pointers from:

i. ATCA 5000 experts who are online;

ii. ATCA Research and Analysis Wing; and

iii. mi2g Intelligence Unit.

Q3: Why is the ATCA 24/7 Q&A Exclusive Club special?

A3: ATCA 24/7 has now created an exclusive private intelligence watering hole and expert roundtable at the highest level where interesting and sophisticated questions are being asked from around the world, and intelligent answers are being provided, almost always by experts who have deep domain-specific knowledge. Come and check out the exclusive club, take it for a strategic test drive, which sign-of-intelligent life are you waiting for?

To learn more about "The Expert Roundtable: ATCA 24/7 Q&A Club" email: intelligence.unit at mi2g.com and if you are already a member visit https://www.yammer.com/atca

We welcome your thoughts, observations and views. To reflect further on this subject and others, please respond within Twitter, Facebook and LinkedIn's ATCA Open and related discussion platform of HQR. Should you wish to connect directly with real time Twitter feeds, please click as appropriate:

. ATCA Open

. @G140

. mi2g Intelligence Unit

. Open HQR

. DK Matai

Best wishes