Switzerland's New Controls for Runaway Alternative Investments, Shadow Banking & Tax Avoidance Schemes?

London, UK - 15th April 2012, 12:05 GMT

Dear ATCA Open & Philanthropia Friends

[Please note that the views presented by individual contributors are not necessarily representative of the views of ATCA, which is neutral. ATCA conducts collective Socratic dialogue on global opportunities and threats.]

Switzerland is preparing sweeping new rules for its traditionally freewheeling private wealth management, investment banking, alternative investment and shadow banking industry, in an overhaul that is likely to unsettle investors and asset managers around the world. Based on the high density of emails and telephone calls received, ATCA 5000's distinguished members -- chairmen and chief executives, senior bankers, high-ranking government officials, significant investors, asset managers and ultra high net worth individuals -- from more than a hundred countries are seeking to get to grips with the potential scope of the proposed new Swiss laws, which have yet to be translated into English.

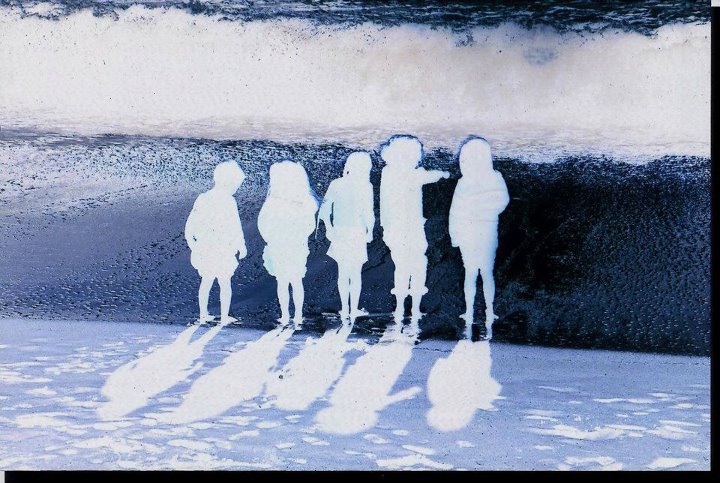

Alternative Investments and Shadow Banking: Transparent Next Generation

Alternative Investments and Shadow Banking: Transparent Next Generation

Alternative Investments and Shadow Banking: Transparent Next Generation

Next generation alternative investments and shadow banking regulations assuring greater transparency have been proposed by the Swiss Federal Council and must now work their way through the Swiss parliament. The proposed laws are intended to bring Switzerland into line with the European Union’s own policies, but are much more draconian in some key areas. Under the EU’s new directive, the Alternative Investment Funds Management (AIFM) industry including:

1. Structured products;

2. Hedge funds;

3. Financial derivatives including managed futures;

4. Commodities including food, energy and precious metals;

and to some extent:

5. Private equity;

6. Venture capital;

7. Luxury valuables and collectibles including art, wine, antiques, coins or stamps; and

8. Film production;

must provide investors and regulators with detailed information on their activities; submit to independent audits; and abide by restrictions on leverage and staff pay.

Much Tighter Regulations Going Forwards

Specifically, Swiss Federal Council officials have stated that they are working to amend the Collective Investment Schemes Act (CISA) to bring it and Switzerland in line with requirements of the Alternative Investment Funds Managers Directive (AIFMD) issued by the European Commission (EC). According to the Federal Council, if Switzerland does not adopt new, tighter regulations the country risks becoming a haven for investment schemes that wish to avoid more proactive regulation currently being pursued by the EC.

New Swiss Proposals for Alternative Investments and Shadow Banking

New Swiss proposals in regard to Alternative Investment Funds Management (AIFM) that heavily impact the Shadow Banking System (SBS) seek compliance with extra requirements laid out by the Swiss Financial Market Supervisory Authority (FINMA). Under the new regime:

I. Quality of asset management is to be raised substantially and investor protection strengthened according to FINMA;

II. For example, Swiss investors, who form one of the biggest client bases for the $2 trillion global hedge fund industry, will be affected;

III. Any overseas investment fund that takes money from a Swiss institution or Swiss investor:

a. will have to comply with FINMA regulations; and

b. must have a permanent representative based in Switzerland;

IV. Considering the specific duties of a permanent representative of an overseas investment fund based in Switzerland, it is expected that the new rules will substantially impede the distribution of foreign fund units to Swiss qualified investors;

V. Asset managers around the world who fail to meet the new Swiss demands could be forced to surrender hundreds of billions of dollars equivalent at the very least with the very real possibility of shedding a few trillion dollars equivalent;

VI. The mainstay of Switzerland’s financial sector, wealthy individuals -- with financial assets of at least CHF 2 million -- are also to be stripped of their automatic status as “qualified investors” permitted to deposit money with hedge funds directly; and

VII. FINMA’s new requirements may include demands for tax and asset transparency as well as minimum standards of governance and rigorous regulatory oversight. [ATCA Briefing: Eleven Offshore Banks On The US Radar: What Happens Next To Swiss-Based Private Banking? 12th February 2012]

What is the Real Reason Behind What Switzerland is Doing?

1. Switzerland is trying to avoid being the next Iceland in the Alps where total banking liabilities exceed national GDP by several hundred percent by curtailing the scale, size and scope of its private wealth management, investment banking, alternative investment and shadow banking industry; because

2. It may not be possible for the US Federal Reserve, European Central Bank (ECB) and other central banks to offer emergency assistance to the Swiss National Bank (SNB) at the onset of the next financial crisis, like they did the last time round only a few years ago; given

3. The Eurozone crisis and other ongoing global financial crises as well as the bitter tax spats underway between Switzerland and other major countries including the US and European powers in regard to tax avoidance schemes offered to their citizens by Swiss financial institutions that have already claimed the life of Wegelin, the oldest private bank in Switzerland established 270 years ago in 1741, which collapsed in January 2012. [ATCA Briefing: What Really Happened To The Oldest Bank in Switzerland? Wegelin: Death Throes of Swiss Banking Secrecy & Asymmetric Risk to Swiss Banks, 1st February 2012]

What is the Shadow Banking System?

The alternative investment fund management industry lies at the heart of shadow banking. The Shadow Banking System (SBS) is an unregulated, unreported mechanism that has been built in layers as a quasi-invisible financial transmission mechanism. Specifically, SBS is the collection of financial entities, infrastructure and practices which support financial transactions that occur beyond the reach of existing nation state sanctioned monitoring and regulation. It includes entities such as hedge funds, money market funds and structured investment vehicles. Investment banks and alternative investment fund managers may conduct much of their business via shadow banking entities. A black swan event, such as large scale municipal or Eurozone sovereign default or a Middle East trade blockage, could potentially cause various asset bubbles supported by shadow banking entities to burst.

Excessive Leverage: Massive Risks Associated with Shadow Banking

As alternative investment funds including shadow banking entities do not take deposits, they are subject to less regulation than traditional banks. They can therefore increase the rewards they get from investments by leveraging up much more than their mainstream counterparts and this can lead to risks mounting in both the national and trans-national financial systems. Unregulated shadow banking entities can be used to circumvent the strictly regulated mainstream banking system and therefore avoid rules designed to prevent financial crises. Shadow banking entities can also cause a build-up of systemic risk indirectly because they are inter-related with the traditional banking system via credit intermediation chains, meaning that problems in this unregulated system can easily spread to the traditional banking system. As shadow banking entities use a lot of short-term deposit-like funding but do not have deposit insurance like mainstream banks, a loss of confidence can lead to "runs" on these unregulated entities and this is precisely what happened in the midst of The Great Unwind (2007-?) and The Great Reset (2008-?). Shadow banking entities' collateralised funding is also considered a risk because it can lead to high levels of financial leverage. For example, by transforming the maturity of credit -- such as from long-term to short term -- shadow banking entities fuelled real estate bubbles in the mid 2000s that helped cause the massive global financial crisis when they burst in 2007-08.

Off Balance Sheet Manipulation

The core activities of investment banks are subject to regulation and monitoring by central banks, regulators and other government institutions -- but it has been common practice for investment banks and alternative investment fund managers to conduct many of their transactions in ways that don't show up on their conventional balance sheet accounting and so remain mostly invisible to regulators or unsophisticated investors. For example, prior to the global financial crisis which began in 2007, investment banks financed mortgages through off-balance sheet securitisations and hedged risk through off-balance sheet credit default swaps, which fall under the category of Alternative Investment Funds Management (AIFM).

How Big is the Shadow Banking System? Potential for Quadrillion dollar Claims and Liabilities

Globally, a study of the 11 largest national Shadow Banking Systems (SBS) found that they totalled up to $50 trillion in 2007, fell to $47 trillion in 2008 but by late 2011 had climbed to $51 trillion, just over the estimated size of SBS before the crisis and comparable to the world GDP. Overall, the world wide SBS totalled about $60 trillion as of late last year, ie, 2011. It now constitutes more than a quarter of the entire global financial system and is about half the size of traditional banks. The US has the largest shadow banking sector at $24 trillion but its overall share of the global shadow banking sector has declined since 2007 from 54% to 46%. [Ref: Financial Stability Board] In the event of a total collapse of SBS, with most counterparties going bust, the total claims and liabilities estimated by the mi2g Intelligence Unit (mIU) and the ATCA Research and Analysis Wing (A-RAW) are likely to multiply by 20 to 25 times, given the excessive leverage, ie, in the range of $1.2 quadrillion to $1.5 quadrillion. [ATCA Briefing: Derivatives Quadrillion Play: How Far Away Are We From A Second Financial Crisis? 23rd March 2010]

Did Shadow Banking Cause the Global Financial Crisis?

The Shadow Banking System (SBS) has been implicated as a significant contributor to the global financial crisis now manifest since 2007 and showing limited signs, if any, of being erased in 2012. In a June 2008 speech, US Treasury Secretary Timothy Geithner, then President and CEO of the New York Federal Reserve, placed significant blame for the freezing of credit markets on a "run" on the SBS entities by their counterparties. The rapid increase of the dependency of bank and non-bank financial institutions on the use of these off-balance sheet entities to fund investment strategies had made them critical to the credit markets underpinning the financial system as a whole, despite their existence in the shadows, outside of the regulatory controls governing commercial banking activity. Furthermore, these entities were vulnerable because they borrowed short-term in liquid markets to purchase long-term, illiquid and risky assets. This meant that disruptions in credit markets would make them subject to rapid deleveraging, selling their long-term assets at depressed prices in illiquid market conditions.

Conclusion

According to the Swiss Funds Association amongst other knowledgeable high-level sources:

1. Many new Swiss provisions in regard to alternative investments and shadow banking go beyond the EU standards, or create specific Swiss features where there are no international standards to date;

2. Major financial institutions and financial entities including asset managers are likely to cut jobs in distribution in Switzerland and it is likely to become unattractive to foreign asset managers;

3. Further, the volume of Swiss funds for qualified investors is likely to stagnate and this may lead to a mass exodus and migration abroad over the long term;

4. There is a clear and present danger of an existential threat in regard to the vast spectrum of funds on offer to Swiss financial institutions being significantly 'slashed'; and

5. There are no proposals whatsoever for strengthening competitiveness in the value-chain segments asset management, administration and distribution of collective investment schemes, this despite the fact that these were specifically covered in the Swiss Federal Council’s report on strategic directions for Switzerland’s financial market policy.

The new Swiss laws are likely to:

6. Accelerate job losses and the mass exodus and migration of entire financial product categories including private wealth management, investment banking, alternative investment and Shadow Banking Systems (SBS) out of Switzerland and away from Swiss-domiciled financial institutions and financial entities;

7. Effectively limit the possibility to distribute offshore alternative investment funds in Switzerland;

8. Move Switzerland from zero regulation of Alternative Investment Funds Management (AIFM) and Shadow Banking Systems (SBS) to massive regulation in one fell swoop;

9. Choke off Swiss domiciled financial institutions' and financial entities' trans-national as well as domestic operations by dramatically cutting leverage, shrinking the size of assets under management and scope of the entire financial services sector, thereby reducing its significant contribution to the Swiss GDP and national economy; and

10. The potential shock of the new Swiss alternative investment and shadow banking regulations may be absolutely unprecedented with massive unknown unknown consequences spawning multiple black swans around the world.

[STOPS]

What are your thoughts, observations and views? We are hosting an Expert roundtable on this issue at ATCA 24/7 on Yammer.

[ENDS]

Expert Roundtables

Expert roundtables are the newly launched ATCA 24/7 Q&A private exclusive club service. They seek to become the killer application in strategic intelligence by delivering an unprecedented competitive advantage to our distinguished members. They can only be accessed online at https://www.yammer.com/atca

Q1: How to become a privileged member of ATCA 24/7 to participate in the expert roundtables?

A1: i. If you are a distinguished member of ATCA 5000, ATCA Open, The Philanthropia or HQR affiliated groups you may be allowed to become a privileged member of this new and exclusive private club.

ii. If you are pre-invited, visit the private intelligence network -- PIN -- by going to https://www.yammer.com/atca [Note: In https:// 's' is for security and encryption]

iii. If you don't have membership of the PIN yet, email the mi2g Intelligence Unit at intelligence.unit at mi2g dot com for an exclusive invitation.

Q2: How to participate in the expert roundtables and get domain-specific strategic intelligence questions answered?

A2: Access the ATCA 24/7 Private Intelligence Network -- PIN -- online and ask or answer a strategic intelligence question, no matter how complex. Receive expert answers within 24 hours or get pointers from:

i. ATCA 5000 experts who are online;

ii. ATCA Research and Analysis Wing; and

iii. mi2g Intelligence Unit.

Q3: Why is the ATCA 24/7 Q&A Exclusive Club special?

A3: ATCA 24/7 has now created an exclusive private intelligence watering hole and expert roundtable at the highest level where interesting and sophisticated questions are being asked from around the world, and intelligent answers are being provided, almost always by experts who have deep domain-specific knowledge. Come and check out the exclusive club, take it for a strategic test drive, which sign-of-intelligent life are you waiting for?

To learn more about "The Expert Roundtable: ATCA 24/7 Q&A Club" email: intelligence.unit at mi2g.com and if you are already a member visit https://www.yammer.com/atca

We welcome your thoughts, observations and views. To reflect further on this subject and others, please respond within Twitter, Facebook and LinkedIn's ATCA Open and related discussion platform of HQR. Should you wish to connect directly with real time Twitter feeds, please click as appropriate:

. ATCA Open

. @G140

. mi2g Intelligence Unit

. Open HQR

. DK Matai

Best wishes